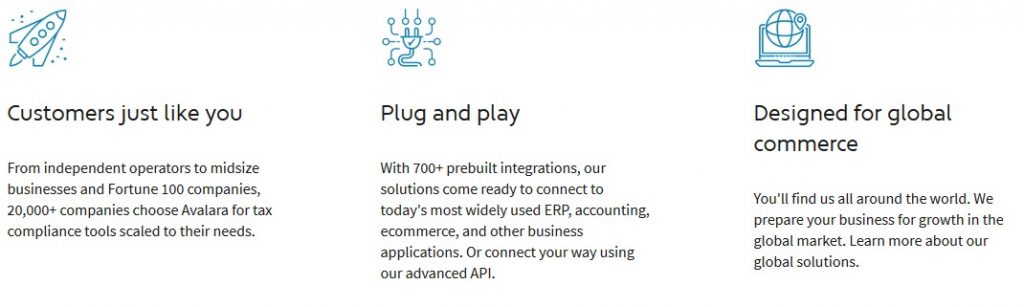

Avalara is a tax compliance tool that aims to sync with your Amazon control panel and pull all of your transaction data, allowing you to file tax returns rapidly for multiple countries and making it easy to keep on top of your tax obligations.

For those who are selling large quantities of products across multiple marketplaces, keeping on top of the tax rules in all the different countries and submitting tax returns on time can be borderline impossible, especially for smaller Amazon businesses or those run by sole traders.

Avalara is a self-contained specialist tool focused entirely on tax as opposed to a comprehensive solution to everything an Amazon seller might face, which puts it amongst the best Amazon seller tools in the industry such as KeyworX.

But what features does Avalara offer, and how does it compare to other tax compliance solutions out there?

Join us and we’ll take you through everything:

What is Avalara and What Can It Do For Me?

Avalara is a leading tax compliance software that’s available for Amazon sellers aswell as other eCommerce sellers due to it’s compatibility with multiple platforms, combined with the fact you can import CSV transaction data even from the platforms that aren’t directly compatible.

Avalara aims to make filing tax returns as easy as possible by automating the process, generating accurate returns quickly based on your past transaction data.

Avalara includes solutions for:

- Sales and use tax

- Excise tax

- Value-added-tax (VAT)

- Goods and Services tax

- Lodging tax

- Communications tax

- Customs duty and import tax

It is used by sellers from countless industries, and isn’t just for Amazon sellers – but the way it allows you to file tax returns with almost no effort at all will certainly be of interest to Amazon sellers!

Tax calculation, document management, and returns preparation all in one dashboard is powerful indeed, but let’s take a look at the individual features to see how well they hold up:

Amazon Germany Marketplace and VAT Liability

A recent change to laws round VAT is something Amazon sellers will want to be aware of:

What is happening?

In November 2018, the German Parliament passed a new law making online marketplaces legally potentially responsible for unpaid VAT by third-party merchants on their platforms. This is a landmark ruling as it means that Amazon and other marketplaces could be fined if they fail to ensure that sellers are handling their German VAT correctly.

The move follows similar legislation passed in the UK in March 2018 and in Italy in January 2019. The EU is going to replicate similar legislation from January 2021.

Germany is looking to reduce hundreds of millions in lost VAT revenues, much of which is believed to originate from sellers in other countries unaware of their German VAT obligations or deliberately evading VAT. The EU estimates that member states lose a total in €5 billion in e-commerce VAT fraud so it is a big problem that needs to be solved.

What does this mean for me?

The legislation will require marketplaces to confirm that merchants are German VAT registered and compliance in order to have them continue selling within Germany. To prove this to marketplaces, merchants must obtain a Tax Certificate from the German tax office. Marketplaces are obliged to hold a copy of this or face being held responsible for any missing VAT of the merchant. Merchants will probably, therefore, be blocked from marketplaces if they cannot produce their Tax Certificate.

Non-EU sellers will have to appoint a postal agent to obtain their Tax Certificate. This agent must be resident in Germany.

So how could Avalara help me?

Our VAT partner Avalara is able to help companies registered for and file VAT in European Countries. If companies have VAT numbers and are filing returns correctly than there will be no danger of account being shut down. If you would like to hear more about preventing your account being suspended then please contact [email protected] quoting AmazonSEOConsultant and she will be able to consult on the best ways to be compliant in Europe.

Avalara Features

Avalara is a huge relief for those of us who want to succeed selling online. After all, tax compliance is an absolute must, but very few of us can afford that have our own staff on it – especially if we are selling enough to need full time support.

With an hour or two’s work per financial year, you can be tax compliant in every US state or every nation with an Amazon marketplace – and that’s powerful when you’re trying to scale.

Let’s look at the individual types of tax you can handle with Avalara:

Sales & Use Tax

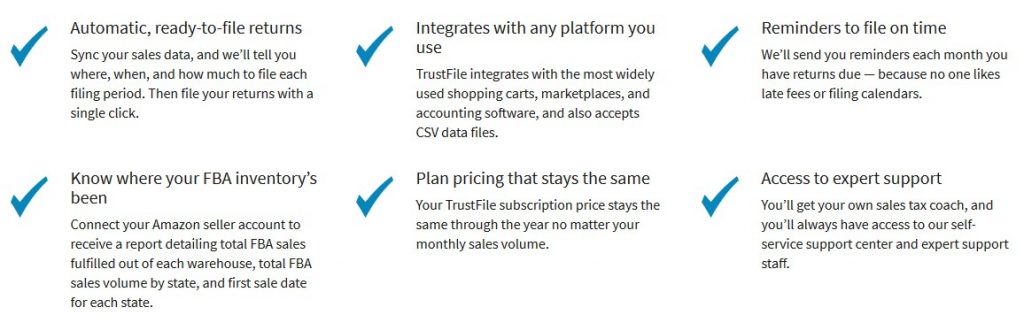

Avalara allows you to consolidate your sales and use tax calculations, documents and returns preparation in a single place, while importing your invoices from elsewhere and managing the calculations for you.

There is no overstating how difficult it can be to keep up with tax rules in multiple countries and states, especially when they are changing regularly.

Avalara helps with this a lot and can even provide reminders when it’s time to submit your returns. You can manage your fiscal calendar in the Avalara dashboard and the tool seamlessly does the calculations, prepares your returns and handles remittance.

Avalara also includes CertCapture, a way to collect and store all of your compliance documents in one place for easy access and validation.

Value Added Tax (VAT)

For those who are selling internationally, VAT can be quite complicated, especially for those from countries that don’t have value added tax.

Avalara has a full database of international VAT laws and transaction tax laws in order to make everything run as efficiently as possible, whether you want to make your business processes more efficient, or simply expand into a new market.

Avalara includes:

- Full VAT reporting and filing

- The most comprehensive online VAT regulation library to provide the appropriate VAT treatment for all transactions

- Global local specialists for managed returns and filing

All of this means you can comfortably run your business and ensure you are paying your dues, without having to spend hours every week parsing through countless invoices.

Customs Duty & Import Tax

Another tax that can be a thorn in the side of many private label Amazon sellers, Avalara can manage customs duty and import tax, both in the case of you selling to people in other countries, and when you import stock from manufacturers.

This allows you to operate more accurately and more efficiently than ever before and also massively reduces the chances of your products being held up in customs, which could cause your customers annoying and unnecessary delays.

It will even calculate your correct duties and allow you to pay them up front, preventing expensive customs rejections and ensuring your business’s logistics run as smoothly as possible.

Whereas those are the main taxes that will interest Amazon sellers, Avalara also helps to manage a variety of other taxes from lodging tax to excise tax, so it can be a great tool for all sorts of businesses.

It works by automatically tagging your transactions with the correct tax – whether it’s VAT, a state-specific US tax, or anything else – then raise invoices and files returns automatically so you’re ready to go.

Avalara Pricing

Avalara costs a flat rate of $20 per month.

This is incredibly cheap for what the tool can do, and a much more attractive price point than any of it’s competitors.

Whereas there are several tax tools that match Avalara in terms of functionality, there are zero that do in terms of value.

Kissing goodbye to hours and hours of checking transactions, organising invoices, and trying to keep everything 100% accurate manually – would you pay $20 per month for this?

It shouldn’t be a hard decision!

Which Amazon marketplaces does Avalara work with?

All of them. If you can sell on Amazon in a country or state, you can use Avalara there.

You can even use it with your other non-Amazon online marketplaces, such as eBay, Etsy, or Walmart.

Can I look up specific tax rates on Avalara?

Sure! You can either use their tax calculator, here, or look up the rates for individual locations here.

Final Breakdown:

Positives:

- Never have to spend hours organising paperwork and tracing back transaction histories again

- Rest assured your tax returns are 100% correct and paid in time

- Drastically increase company efficiency by not needing staff on the above full-time

- Sell globally without having to manually keep track of countless tax regulations and figures

- Unbelievable value at $20 per month

Negatives:

- For $20 a month?! Nothing

Conclusion

Tax is known as being a major headache for most businesses.

From filing appropriate returns and keeping track of taxes in other countries to customs duty and more, there is a lot to keep track of and it’s extremely easy for a minor human error to cost you a lot of money.

Avalara provides a powerful range of tax filing tools that automate the entire process, tagging your transactions with the appropriate tax types, calculating total due amounts, creating invoices and then allowing you to print off complete, ready to file tax returns.

There are plenty of tools out there that do this, and some are even potentially better, but most are several times the cost of Avalara.

None are that much better, and as such Avalara wins a confident recommendation – we use this ourselves to handle our tax returns for all of our Amazon businesses and those of our clients – you can’t get much more of a hearty recommendation than that!

The AmazonSEOConsultant Verdict: 9/10

AmazonSEOConsultant Top Recommendation!Is it difficult for you to find the resources or time to manage your Amazon business and scale it the way you’d like?

Would you rather have the #1 Amazon marketing agency handle your listing optimizations, product rankings, pricing, feedback management strategy. or even all aspects of your Amazon business?

We provide services ranging from full partnerships and Amazon seller account management to one-off product rankings you won’t find anywhere else.

To learn more about how we can offer results and rank positions that nobody else can, take a look at our case studies to see the unbelievable increases in rank, sales and profits that we’ve already achieved for 100s of clients thanks to our unique, self-developed Amazon ranking process.

Or, to get in touch directly and discuss what we can achieve for you, simply request a proposal now!