As of 2024, Amazon seller accounting has undergone significant changes in regulations, tools, and best practices. With the increasing scrutiny on e-commerce platforms, sellers are now required to adhere to even stricter accounting regulations to ensure compliance.

The introduction of new accounting software tailored specifically for Amazon sellers has streamlined the process and helped to maintain accurate financial records. Furthermore, the use of AI and automation tools has significantly improved efficiency in managing sales data, expenses, and inventory tracking.

In terms of best practices, sellers are now focusing on implementing a robust system for tax compliance, proper financial reporting, and cash flow management. It is important for Amazon sellers to stay updated on the ever-evolving tax laws and regulations to effectively manage their finances and avoid potential penalties and fines.

In conclusion, successful Amazon seller accounting in the modern day requires a thorough understanding of accounting regulations, efficient use of accounting tools, and adherence to best practices to ensure accurate financial management.

Let’s look at why these are needed, and the benefits of efficient accurate bookkeeping for Amazon sellers:

The Importance of Proper Accounting for Amazon Sellers

Running a successful Amazon business requires more than just great products and customer service. Proper accounting is essential for Amazon sellers to ensure they are managing their finances effectively, understanding their profitability, and remaining compliant with tax laws. Without a solid accounting system in place, it can be challenging to track expenses, revenues, and ultimately, the overall financial health of the business. This can lead to cash flow problems, inaccurate financial reporting, and potentially costly mistakes, which is why we advise most of our long term clients to put the right system into place early. In fact, the few of our clients that have lost or closed their business almost exclusively did so due to accounting issues.

In this post, we will explore the importance of proper accounting for Amazon sellers, including the benefits of accurate financial records, the role of accounting in decision-making, and how to set up a solid accounting system for your Amazon business. Whether you’re a new seller or an experienced entrepreneur, understanding the significance of proper accounting is crucial for long-term success on the Amazon platform.

Let’s jump in:

Understanding the significance of accurate financial records for business owners

Accurate financial records are crucial for business owners as they serve as the foundation for proper financial management, ensuring tax compliance, and guiding strategic decision-making. Without accurate records, business owners may struggle to track their financial performance, efficiently manage their cash flow, and plan for the future.

Inaccurate financial records can lead to severe consequences such as legal issues, financial losses, and reputational damage. Incorrect financial reporting may result in penalties from tax authorities, damage to the business’s reputation, and potential lawsuits from stakeholders.

On the other hand, maintaining accurate financial records offers numerous benefits to business owners. It allows for improved operational efficiency, better access to financing, and enhanced business credibility. With accurate records, business owners can make informed decisions, access funding from banks or investors, and build trust with stakeholders.

In other words, accurate financial records are essential for business owners to effectively manage their finances, comply with tax regulations, and make strategic decisions for the success and growth of their business – and this is as true for an Amazon business as it is for any other.

How bookkeeping services can assist Amazon sellers in maintaining their accounts

Bookkeeping services can be instrumental in helping Amazon sellers maintain their accounts by managing the financial aspects of their business. This includes tracking sales and expenses, reconciling bank statements, and ensuring that all transactions are accurately recorded. By doing so, bookkeepers help Amazon sellers gain a clear understanding of their financial position and make informed decisions.

Moreover, bookkeeping services can ensure that Amazon sellers stay compliant with tax regulations by accurately categorizing transactions, calculating and filing taxes, and keeping up-to-date with the latest tax laws. This helps sellers avoid penalties and fines from incorrect tax filings.

Additionally, bookkeeping services provide valuable financial insights and reports that can offer Amazon sellers an in-depth understanding of their business performance. These insights can include sales trends, expense patterns, and profit margins, enabling sellers to make strategic decisions and improve their bottom line.

Overall, bookkeeping services are essential for Amazon sellers to stay organized, compliant, and to gain valuable financial insights that can ultimately drive business success.

Key Bookkeeping Tasks for Amazon Sellers

As an Amazon seller, it’s essential to stay on top of your bookkeeping tasks to ensure accurate financial records and compliance with tax regulations. Your bookkeeping tasks not only track your business’s financial health but also help you make informed decisions to grow your Amazon business. In this article, we will explore the key bookkeeping tasks that Amazon sellers should prioritize to maintain financial transparency, monitor business performance, and stay organized come tax time. From tracking sales, managing expenses, and reconciling accounts to preparing for tax filing and monitoring cash flow, these essential bookkeeping tasks will help you manage your Amazon business effectively and efficiently.

Analyzing financial reports and statements

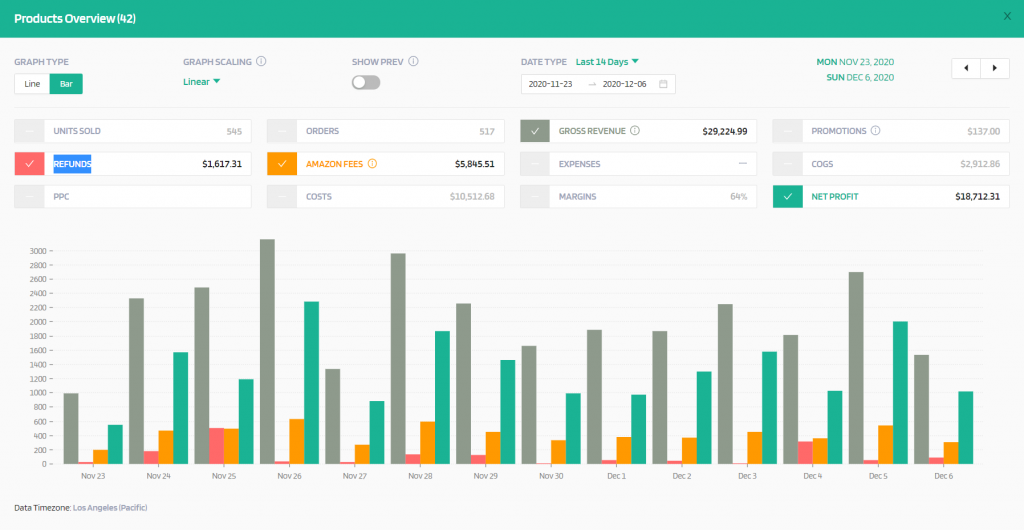

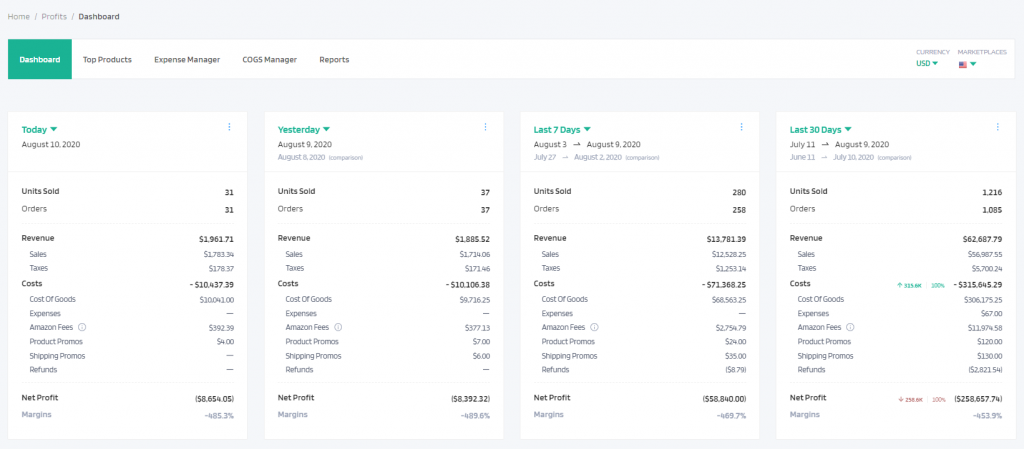

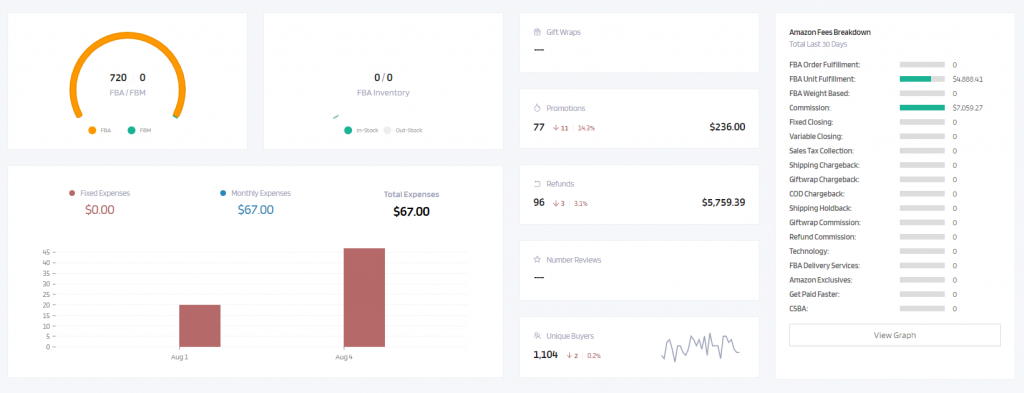

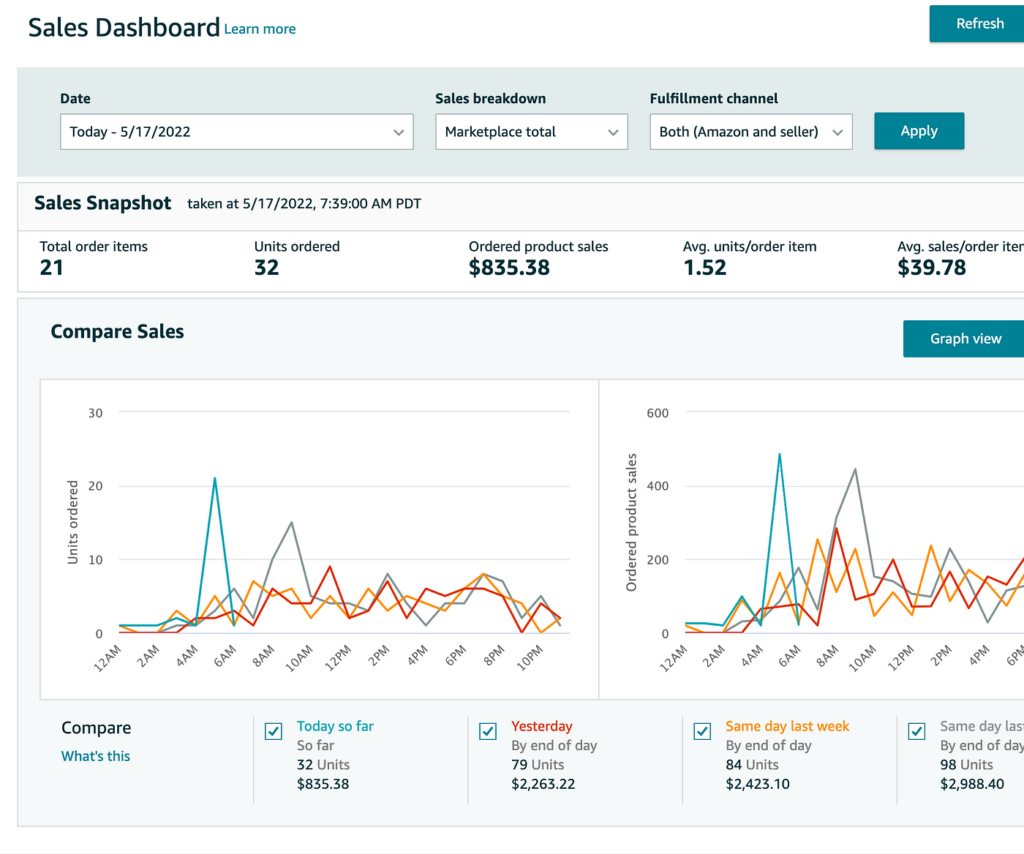

Analyzing financial reports and statements is essential for understanding the financial health of a business. Start by identifying key financial metrics such as revenue, gross margin, operating income, and return on investment. Compare these metrics against industry benchmarks to gauge performance and identify areas for improvement. Use these insights to drive business growth and profitability by making informed decisions regarding pricing strategies, cost controls, and investment opportunities.

Regularly reviewing profit and loss statements, balance sheets, and cash flow statements is crucial to ensure accurate financial reporting. This involves checking for any discrepancies or errors that may impact decision-making. It also allows for monitoring of financial trends and identifying potential risks or opportunities.

By staying on top of financial analysis and utilizing key financial metrics, businesses can make strategic decisions that lead to increased profitability and sustainable growth. Monitoring industry benchmarks and adapting to changes in the market ensures that the business remains competitive and financially sound.

Tracking expenses and managing profit margins effectively

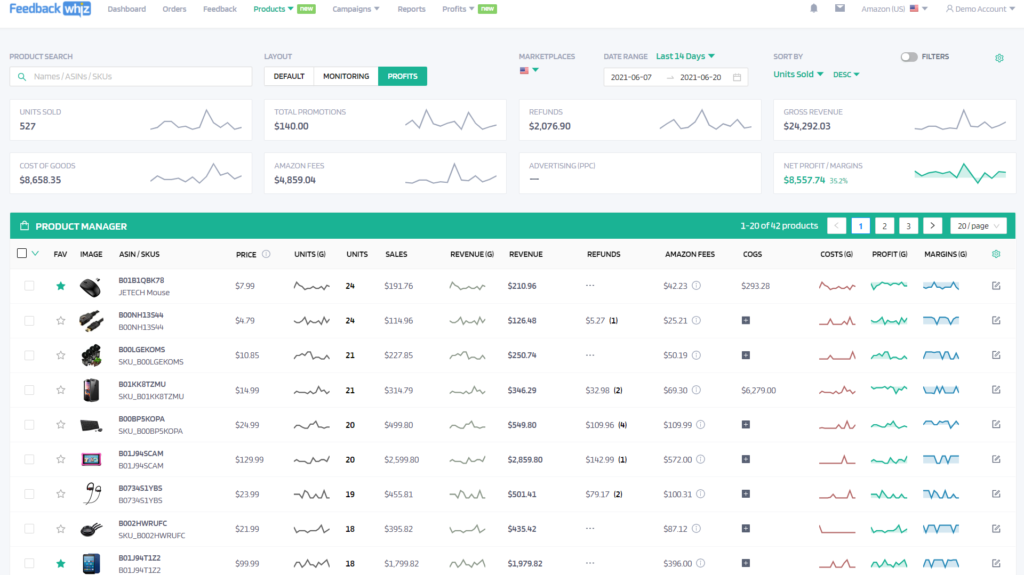

To effectively track expenses, start by utilizing Amazon accounting tools to monitor costs and sales data. This will give a clear understanding of where expenses are being incurred and where potential savings can be made. Regularly analyze and categorize expenses to identify areas for cost reduction and improved efficiency. Utilize accounting software to track and manage all expenses, including fees, inventory, shipping, and other operational costs.

Additionally, it is crucial to manage profit margins effectively to ensure long-term profitability and financial health. By understanding and optimizing gross margins, businesses can accurately assess pricing strategies and identify opportunities to increase profitability. Monitoring gross margins allows for better decision-making when it comes to pricing, promotions, and inventory management. Regularly assess the impact of expenses on profit margins to maintain a healthy financial position and sustainable growth. Overall, effective expense tracking and management of profit margins are essential for achieving long-term profitability and financial health in the Amazon marketplace.

Ensuring proper recording and categorization of sales transactions

- Accurately capture the details of each sales transaction, including the date, customer information, product details, and the amount of the sale.

- Categorize each transaction according to type, such as product sales, fees, refunds, and any other relevant categories.

- Ensure that all sales and revenue are accurately recorded in your accounting system, with specific attention to the proper categorization of each transaction.

- Utilize accounting software to simplify this process and ensure accuracy and compliance with accounting standards and tax regulations.

- Regularly reconcile sales transactions in your accounting software with your Amazon business account to identify and rectify any discrepancies.

By following these essential steps, you can ensure the proper recording and categorization of sales transactions within your Amazon business. This will help you maintain accurate financial records, make informed business decisions, and remain compliant with accounting and tax requirements.

Utilizing Accounting Software for Efficient Management

In today’s fast-paced business world, utilizing accounting software has become essential for efficient management. From tracking expenses and revenue to generating financial reports, accounting software streamlines the entire process, saving time and reducing the risk of human error. Whether you are a small business owner or a large corporation, a good accounting software can help you manage your finances more effectively and make informed business decisions. This article will delve into the various benefits of using accounting software and how it can improve the efficiency of financial management.

Exploring various accounting software options for Amazon sellers

- QuickBooks Online: QuickBooks Online is a popular accounting software that offers features such as invoicing, expense tracking, and financial reporting. It seamlessly integrates with Amazon seller accounts, allowing for automatic synchronization of sales, fees, and expenses. Cost starts at $25 per month.

- Xero: Xero is a cloud-based accounting software known for its user-friendly interface and advanced reporting capabilities. It integrates with Amazon seller accounts to provide real-time updates on sales and fees. The cost for Xero starts at $20 per month.

- A2X: A2X is specifically designed for Amazon sellers, providing automated and accurate accounting for Amazon sales. It reconciles Amazon settlements and integrates with popular accounting platforms like QuickBooks and Xero. Pricing plans for A2X start at $19 per month.

- SellerBoard: SellerBoard is an all-in-one financial analytics and profit calculation software for Amazon sellers. It includes features such as detailed sales analytics, PPC reporting, and inventory management. It can be integrated with accounting software like QuickBooks and Xero. Cost starts at $19.99 per month.

- TaxJar is a sales tax automation software that helps Amazon sellers manage their sales tax obligations. It integrates with Amazon seller accounts to accurately calculate and file sales tax. Pricing plans for TaxJar start at $19 per month.