How to Sell on Amazon UK

For many Amazon sellers, the time will come when you need to start thinking about expanding your operations to a new country or marketplace.

Maybe you’ve scaled your marketing efforts so successfully that you’re starting to reach a point where you’re struggling to find further sales within your home country and have realised that expanding to other countries is the only way to spur further growth.

Maybe your product isn’t selling as quickly as you thought and appears to have more interest elsewhere, so you want to see if selling to more marketplaces will help you to move it quicker.

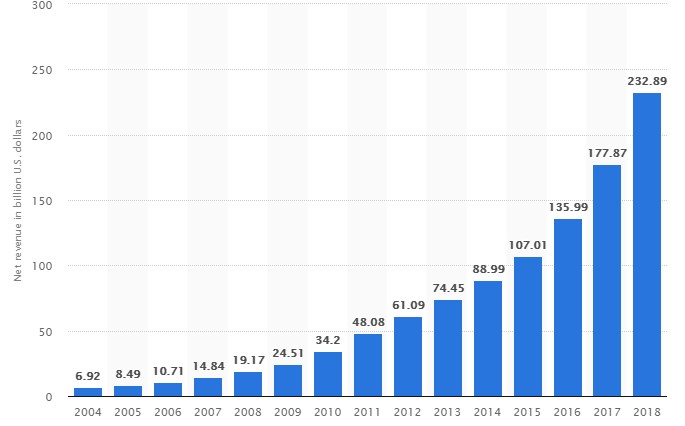

Considering Amazon shipped over 5 billion products globally in 2017, it makes sense that sellers increasingly want to expand to other markets in order to get as big a piece of the pie as possible – especially since the below graph makes it painfully clear how this number will only continue to increase.

For Amazon FBA sellers in the United States, there is an easy and quick way to get access to millions more customers and begin your ascent to being a global empire.

What is it?

It’s as simple as this:

Start Selling on Amazon UK!

Selling on Amazon UK is the perfect first step in a global expansion for US Amazon sellers.

Why?

Here’s just a few reasons:

- 100% of the UK population speak English so your titles, listings and images will likely be ready to go with no edits necessary

- Those selling in the UK marketplace also get access to four other EU marketplaces so continuing to grow is easy

- Learning about VAT in English first will make managing it in other countries a lot easier to understand

- In 2017, Europe had 350 million active Amazon customers – a number that will only have continued to grow since

Considering Amazon handles all of your logistics and shipping, selling your products in another country is a lot easier than you might think.

It’s also an excellent way to boost your visibility and gain a large number of extra sales without needing to do a huge amount of extra work – after all, you’ve already done your product research, keyword research, product photography etc.

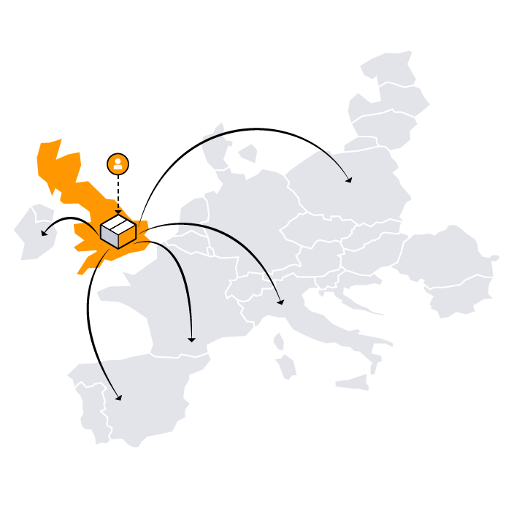

So, what about those other EU marketplaces?

The EU marketplaces are heavily tied together in the same way that the US, Mexico and Canada ones are, and companies selling in one major European marketplace can very easily sell to the others with a single click of a button.

Outside of the UK, these marketplaces include:

- France

- Spain

- Germany

- Italy

That’s a lot of potential extra customers, and certainly not something you should ignore if your goals are to grow and scale your business.

So how do you go about taking this step, and how easy is it to start selling on Amazon UK from the USA?

It’s a lot easier than you might think!

Let’s take a look:

How to Start Selling on Amazon UK

When spreading your US-based Amazon business to the UK, you have a few choices to make.

The first is how you actually register your company.

Don’t worry, it’s a lot less complicated than it sounds:

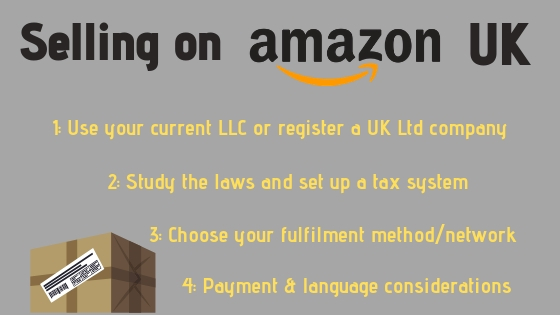

Step 1: Setting Up Your Company Overseas

First, you’ll need to decide whether you want to sell in the UK using your current US- based LLC (limited liability company) or to register a UK Limited Company.

Each has their own unique benefits, so let’s break down the difference:

Using Your Current LLC

This is usually the easiest way since you are continuing to operate as your existing company with no need to set up a new one.

However, you’ll need to register your LLC for VAT (value-added tax) immediately (more on that shortly).

The other potential downside is that Amazon will consider your UK and US operations to be the same seller, which means if you lose your ability to sell somewhere, for example if you accidentally sell a restricted product in Europe, you could lose selling privileges on both accounts, ending your Amazon FBA business.

If you go this route, you’ll need to register for a VAT number immediately and won’t be able to sell any products in Europe until you do.

Registering a UK Ltd Company

Registering a UK Ltd company allows your Amazon UK operations to be run separately to your US one.

This has two major benefits:

- The chances of both of your seller accounts being removed or suspended at the same time are drastically reduced. An issue effecting one will not be tied to the other by Amazon.

- You won’t need to register for VAT immediately, only when you reach the sales threshold that requires you to start paying it.

Now that you’ve got a company that’s allowed to sell in the UK, the next step is to make sure everything is in order in regards to tax:

Step 2: Setting up a Tax System

In order to find official guidance, we recommend reading up on the UK government’s guide to taxation here.

You will need to sign up for a VAT number no matter what, and if you’re fulfilling orders yourself instead of using FBA you’ll also need an EORI number.

The VAT number is a legal requirement to do business in the UK and will also be necessary to get any incorrectly charged tax refunded, so even if you consistently fall below the thresholds required to actually pay VAT, you still need to do this.

The way VAT works is slightly different to sales tax in the US and can be confusing at first. Essentially, the tax is included in the original RRP.

So if you can manufacture a product for 50p, need to sell it for £1 to make your profit margin, and VAT is 20%, you will need to sell your product for £1.20.

The £1 is yours, and you simply hold onto the 20p then pay it to the government.

For smaller Amazon sellers, learning how VAT works and submitted your VAT returns yourself might be manageable, but for larger ones with a lot of UK orders, you will find a lot of value in finding a software tool or accounting service to make this easier for you.

SimplyVAT is a UK-based company that aims to help foreign sellers into the UK marketplace, and they can both register your company for VAT and submit your annual returns for a low price, meaning you can forget about it entirely.

We highly recommend working with them or a similar service as it will take a lot of the effort and stress out of selling in another country.

Would you rather the #1 UK-based Amazon marketing agency manage this for you to maximise your sales?

As the most qualified Amazon marketers with years of experience working from the UK, we are uniquely positioned to help you benefit from our self-developed ranking process.

If you’re interested in learning more, a great first step is to check out our case studies to see the unbelievable results we get for our varied clients.

If you’d rather handle it yourself, simply read on!:

Step 3: Choose Your Method of Fulfilment

When it comes to fulfilment across the European continent and where your products are stored, there are 3 main options.

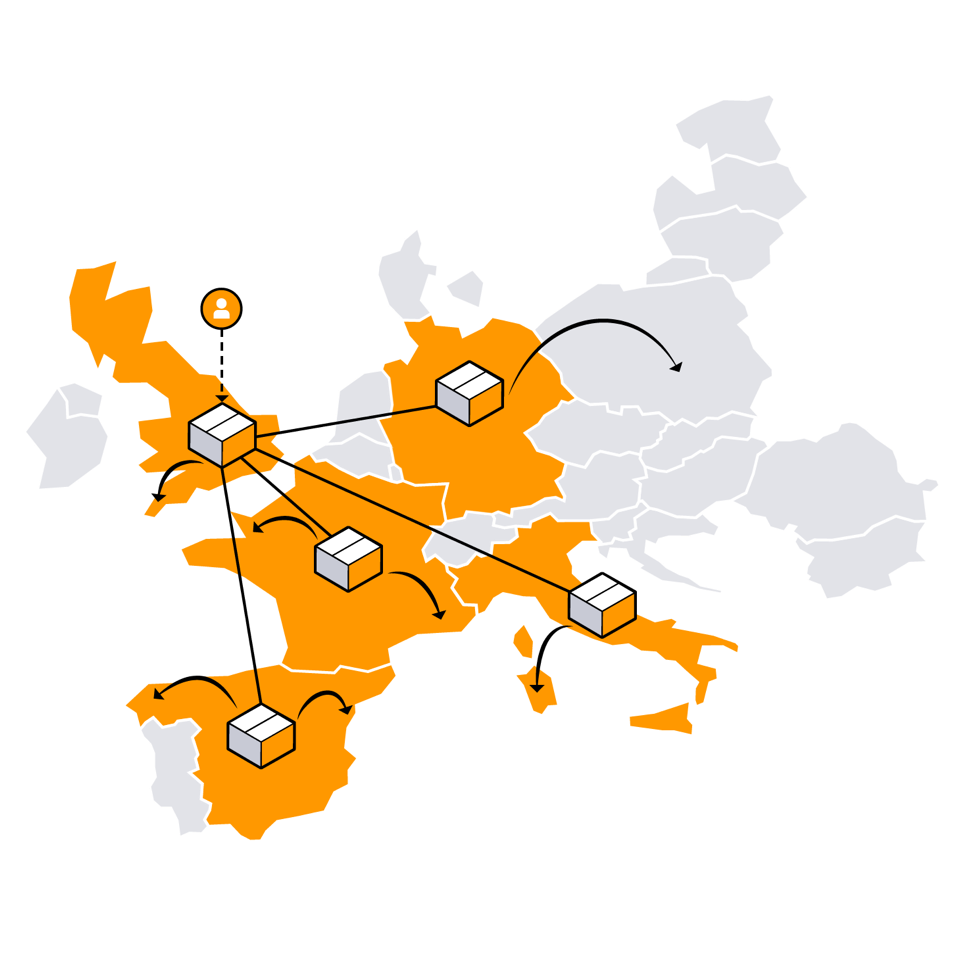

Pan-European FBA is the easiest, and simply involves you shipping your products to a UK fulfilment centre. Amazon will then spread some of your stock around other EU countries depending on their expectations for your sales.

European Fulfilment Network is similar but your stock remains in that one place, being dispatched from there to the entire continent. This can slow some deliveries, for example if a customer in Italy orders a product that is stored in the UK. If you’re only targeting the UK or expecting most of your European sales to come from there (for example if selling an English language book) then this is a good option.

Multi-Country Inventory is when you manually decide which countries you’d like your stock to be sold in and send individual shipments to distribution centres in different countries. This is a good option if you’re expecting higher sales in one country over another, and helps prevent late deliveries or understocking by making sure your items are where your customers are. However if you aren’t sure how your sales volume by country will go yet, it’s best to ignore this option and let Amazon handle it.

Step 4: Payment & Language Considerations

Now that you’ve handled tax and company registration, the main remaining challenges to operating in another country are language and currency.

Language Barriers

Language will mostly be a non-issue when operating in the UK as they speak English, but if you’re expanding to the entirety of Europe you’ll want to translate your product titles, descriptions and bullet points into the appropriate languages (German, French, Spanish etc).

You can hire a local translator to do this manually or hire a dedicated Amazon listing translator.

Amazon do have a free translation service but this is an automated process by a machine and is likely to result in multiple grammar issues, so should only really be used as a last resort.

We find it is generally both cheaper and leads to much better results to hire specialist translators who are experienced in Amazon and copywriting, as they are more easily able to take local slang and colloquialisms into account to ensure your copy reads as well as possible for people from other cultures.

We have reviewed both the cheapest, easiest option and the more expensive but highest quality option in our guide to Amazon seller tools, so check that out to learn more about our personal recommendations.

Currency Barriers

When you sell products in different countries via Amazon, Amazon pays you directly into your existing bank account in your home country.

This is extremely convenient and quick, so you may decide to leave it this way to avoid complicating matters.

However, fluctuating exchange rates mean you will sometimes lose out from this, and services like Payoneer provide a great solution.

These solutions essentially open bank accounts for you in multiple countries and allow you to manage them all from one convenient dashboard.

Even better, Amazon and Payoneer work together so you can set this up through Seller Central.

From then on, you can get paid directly in the home currency of any country you operate in, and only pay yourself into your home account when the time (and exchange rate) is right. This has the benefit of preventing you from losing out due to changes in the international economy, while also allowing you to keep your profits in the currency you were paid in for tax reasons, if necessary.

Selling on Amazon UK: Fees

The cost of selling on Amazon UK, or specifically the Amazon FBA UK fees are likely your next question.

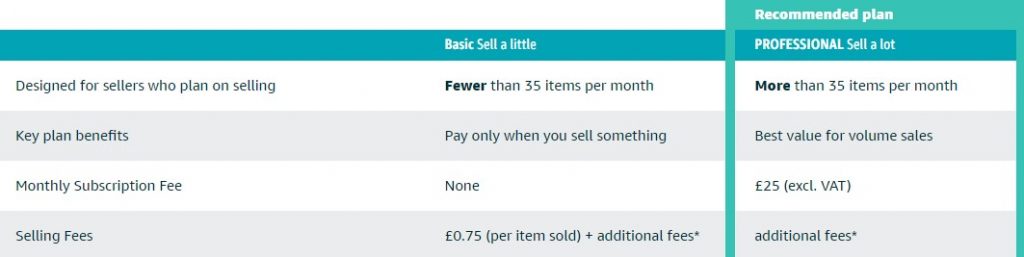

Your seller account is subject to the same choice between basic (pay £0.75 per sale) and professional (pay £25 monthly) as your US account.

In fact, outside of VAT and currency differences, the Amazon UK marketplace fees are virtually identical to the US ones.

You can learn more about this here but as long as you handle VAT and company registration and don’t sell anything restricted, you shouldn’t get any nasty surprises.

We hope this guide has been of use to you. If you follow the steps above, and make use of the tools we’ve recommended, selling via Amazon Central UK will be an easy and sustainable way to boost your sales and grow your business into an entirely new continent.

If you need further help on succeeding on Amazon, check out our complete guide on How to Sell on Amazon.

If you would rather have experts manage your expansion into the UK and maximise your sales so you can focus on what really matters, request a proposal now to see what we could do for you!