For Amazon sellers who operate in multiple countries or states, managing all of the difference tax requirements, thresholds and rates can be a major headache – especially for smaller businesses without an established accounting department.

VAT (or Value Added Tax) is something you’ll need to do correctly if you operate in the UK, France, Germany, Italy or Spain.

For people who grow up in these countries, VAT is just a fact of life, but for sellers from elsewhere, it can be pretty tough to get your head around.

Enter SimplyVAT.

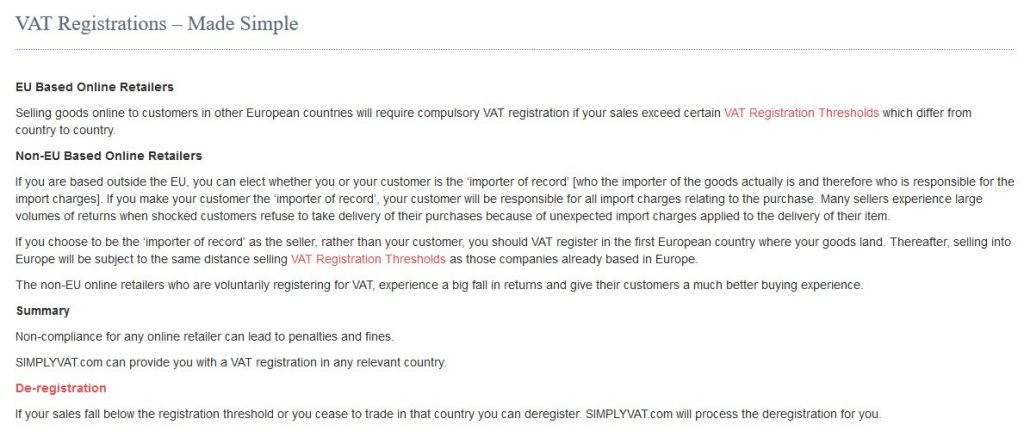

SimplyVAT is an Amazon tax management tool that aims to solve this issue and make it easier for businesses to scale globally by managing VAT compliance solutions for those who need it.

This can mean helping you register in the countries you wish to operate in, to deregister if you are ceasing business in a country or falling below thresholds, and even to submit your annual VAT tax returns for you.

So does it offer great value for those who need help managing their VAT requirements, or can you do just as well without it?

We’re about to break it all down so you can answer that question yourself!

Join us:

What is SimplyVAT & What Can it Do For You?

In fact, SimplyVAT is available for all online sellers, not just those on Amazon, and as a result it can help you manage your VAT compliance in European countries beyond those that have their own Amazon marketplaces.

Here’s the full list:

No matter whether you’re an online seller in the EU selling to people elsewhere in the EU, or whether you’re located elsewhere but have some EU customers, you’ll need to register for VAT and ensure you comply consistently.

It’s a legal requirement and failing to do this can lead to some hefty fines or even being banned from doing business in certain countries.

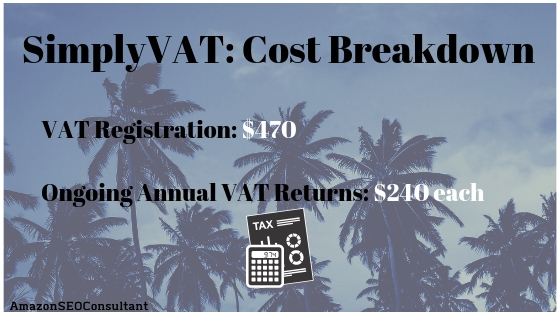

SimplyVAT is able to manage these VAT registrations for you, for a one-off payment of $470, if you wish.

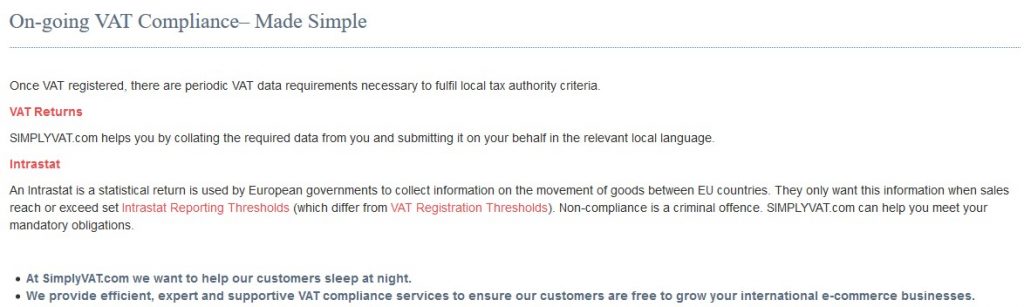

On an ongoing basis, they are also able to manage your VAT compliance, taking care of all calculations, raising your VAT returns, filing them and more to ensure that you can rest easy, safe in the knowledge everything is done correctly.

This costs an extra $240 per year.

This is a unique, focused tool/service hybrid that does exactly what it says on the tin with no waste or filler.

As we know from things like KeyworX, tools that stick to what they know are usually the best, but is that the case here?

In our experience, yes.

SimplyVAT makes it a breeze to calculate how much VAT you owe on each invoice and in total.

Working out VAT for different customers in different countries can be a scatterbrained process, especially since rates aren’t the same everywhere and may even vary on different products within the same country.

SimplyVAT turns what could be a huge timesink into something barely noticeable, and this is something that should be on every Amazon seller’s wishlist.

After all, VAT compliance is extremely strict in Europe, and attempting to serve customers with there without complying appropriately could land you in some serious trouble, or even be the end of your business.

One thing we’ve learned from working with our varied clients is that Amazon sellers have a lot on their plate, and no matter whether you’re a sole trader trying to make money selling a few items, or a global business selling millions of products around the world – you don’t want to be wasting time and resources on things you don’t need to, especially things that your staff can get wrong and cost you even more money.

Letting SimplyVAT handle it just makes sense, to us. You may disagree, and that’s fine, but if we know Amazon sellers and the amount of constraints they have on their time, you almost certainly won’t!

Here are just a few of the benefits you can expect from using SimplyVAT:

- Your goods will always be approved by local tax authorities

- They also clear customs rapidly, saving your customers in time and protecting both of you from potential customs charges, which can be audaciously huge

- No more risk to your cashflow

- You can rest easy knowing you’re safe from tax-related penalties or fines

- There is suddenly nothing major stopping you from operating in all EU marketplaces – if you have the inventory, you can do it

All of this is good news for anybody looking to scale their Amazon business internationally!

SimplyVAT is also able to manage deregistration for you, for example if you ever decide to cease operations in a certain country or fall below the VAT threshold.

Distance Sales Checker

With the Distance Sales Checker, SimplyVAT offers a free VAT check.

This is where they check all of your existing transactions to see which EU countries you need to be VAT registered in, if any.

Generally, it is the first step of working with SimplyVAT, but you can run a free check even if you aren’t convinced you want to work with them, simply to find out if you need to be doing something.

The same software they use to run this check will be watching your transactions for good if you decide to subscribe and work with them in the long term, which is how they keep track of your thresholds, different countries you’re operating, and how much you should be paying in each.

We also have to say that we were pretty impressed by SimplyVAT’s educational resources – there are blog posts, videos, eBooks and more, and they are all fairly high-quality content. Topics include things that will be super valuable to people outside the EU who are looking to learn more about VAT, such as how online VAT fraud works and what to watch out for, tips on expanding your business to the EU, what Brexit means to you and more.

SimplyVAT Pricing

As mentioned above, SimplyVAT offer a free VAT check as the first stage.

After this, they can VAT register you in any EU country you desire for $470.

So far, these are all one-off deals that don’t lock you in to any sort of subscription or ongoing deal with SimplyVAT, but if you still want their help once fully VAT registered, you can pay $240 a year on an ongoing basis for them to manage all of your compliance automatically and submit your tax returns as a matter of course, allowing you to forget about it entirely and focus on marketing, product research, or wherever else you need to prioritise.

Even for new or small Amazon sellers with a tight budget, this is really cheap and a good investment, but for larger businesses with a lot of difference tax obligations to handle, it’s an absolute must.

How is VAT Collected?

The seller is obligated to charge the correct amount to the buyer and then pass the VAT over to the government.

The customer has no obligations at all here – it’s all on you, which is why it’s so important not to slip up.

For example, if you have a product that you have set a retail price for at £1 after considering all production and marketing costs, and VAT is 20%, you’ll have to make the retail price for the product £1.20, then hand the 20p straight over to the government.

Essentially, it works similarly to US sales tax, with the main difference being VAT is shown in the RRP or price label in the first place, as opposed to being added on top of the RRP at the till.

How long after applying do I have to wait for my VAT number?

It depends on the country but you should get your VAT number within 6 weeks.

Final Breakdown

Positives:

- Makes VAT a breeze – something it generally isn’t

- Allows you to ensure your business (and cashflow) keeps running effectively

- Very simple and fair pricing setup

- Easy to use and great customer service

- An easy and powerful solution for anybody looking to file VAT returns

Negatives:

- May be unnecessary for those with a large enough internal accounting team – otherwise, nothing

Conclusion

It’s as a simple as this:

If you sell on Amazon UK, France, Germany, Spain or Italy, VAT is a legal necessity.

SimplyVAT makes calculating the appropriate VAT and submitting returns so easy you won’t really need to think about it again.

In our opinion, for the cost, this is a no-brainer for anybody in that situation.

The ability to get accurately VAT registered in any eligible country for a one-time fee is a lifesaver, but the real benefit comes when they continue to automatically file your returns allowing you to essentially operate as if VAT wasn’t even a thing.

SimplyVAT have certainly found an excellent niche and offering here, and it earns a heart recommendation from us.

The AmazonSEOConsultant Verdict: 8/10

Is it difficult for you to find the resources or time to manage your Amazon business and scale it the way you’d like?

Would you rather have the #1 Amazon marketing agency handle your listing optimizations, product rankings, pricing, feedback management strategy. or even all aspects of your Amazon business?

We provide services ranging from full partnerships and Amazon seller account management to one-off product rankings you won’t find anywhere else.

To learn more about how we can offer results and rank positions that nobody else can, take a look at our case studies to see the unbelievable increases in rank, sales and profits that we’ve already achieved for 100s of clients thanks to our unique, self-developed Amazon ranking process.

Or, to get in touch directly and discuss what we can achieve for you, simply request a proposal now!