If you’ve been selling on Amazon for a while, or recently checked out our guide to Amazon FBA, you’re no doubt well aware of the wide reach and huge potential audience selling on Amazon can provide.

But many people hesitate to sell in other countries – thinking language barriers or differences in legality will be more of a headache than they’re worth.

If you’re a US Amazon seller who has previously only stocked their items in United States distribution centers, expanding your reach to sell on Amazon Europe may just be what you need to stimulate your business into the next stage of growth.

But how do you get your head around all these different marketplaces and their different rules?

In this post, we’ll take you through everything you need to know to start selling on Amazon Europe.

First things first:

Decide Which European Marketplace You Want to Start With

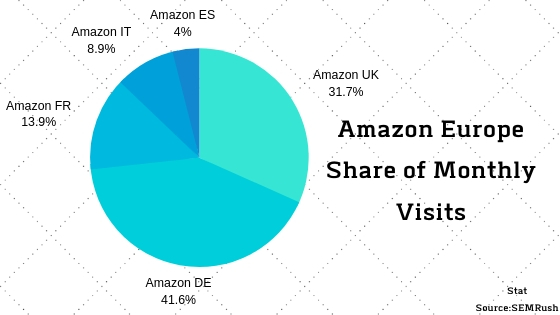

You can decide whether to sell in one of the 5 European Amazon marketplaces or in all of them. Despite this, you do have to choose a “home” marketplace at first. This is a good thing and even if it wasn’t the case we would recommend starting with one, as dealing with all of the different local tax setups can get complicated pretty quickly.

The best ones to start with for somebody from the US is the UK (because they speak English) and Germany (because it’s the biggest European market, less competitive than the UK, and a lot of them speak English too).

However, the total list you have to consider is made up of:

- United Kingdom

- Germany

- France

- Spain

- Italy

The Netherlands has recently also launched a new European marketplace, however this is still not fully featured and is not set up as part of Pan European FBA as of yet. Regardless, it is worth watching.

Questions to ask yourself when wondering which marketplace to begin with include:

- Which one gives me the best entry into the European marketplace logistics-wise? (tax, shipping etc)

- Which one is the easiest to get started in, in terms of demand for my product type and competition?

- Which one is easiest/cheapest for me to distribute my European inventory from?

Study the Laws in Your “Home” Marketplace In-Depth

| Country/Government | Resource Link | Language |

| Europe | Taxation and Customs Union | English |

| UK | UK Government VAT Guide | English |

| Germany | Federal Ministry of Finance | English |

| France | Foreign Country’s Tax Obligations | English |

| Italy | Agenzia Entrate | Italian |

| Spain | Agencia Tributaria | Spanish |

When selling across Europe, your legal obligations can get pretty complicated as there are EU regulations to follow as well as individual laws in each country.

Starting with the EU and your “home” marketplace is generally the best first step as this is a lot less complicated than trying to learn about all of the marketplaces at the same time, and makes learning about the other marketplaces later a lot more manageable.

If you aren’t too legally inclined yourself, it is often a good idea to hire an international lawyer who is able to explain everything to you and help you set up processes around things such as VAT (value added tax) and customs documentation and fees.

Other things that you should really get your head around at this stage include:

- Consumer rights and differences in regulations around things like returns and advertising

- Health & safety obligations

- Environmental standards

- IP law

- Invoicing, labelling and packaging regulations

Amazon does keep a reference page for all of this which can be a great start but it’s also fairly vague so we recommend using it as a guide on what you need to learn, as opposed to your main source of information.

Choose Your Fulfilment Method

As you are likely aware, there are two main business models when selling on Amazon.

The most popular and common is Amazon FBA – our full guide will explain that in detail if you aren’t already aware of it.

To summarise, FBA is when all of your inventory is stocked in Amazon’s facilities and they fulfil your orders for you.

The other option is FBM or fulfilled by merchant – where you stock and send everything yourself.

Let’s break down the differences in these two business models a little further because each has unique characteristics when applied to the European marketplace:

Fulfilled by Merchant, or Amazon FBM

Fulfilling your orders yourself may seem a good option if you’re selling a few items to customers in your own country, but to do it for customers in Europe comes with some major downsides.

For one, you can either ship your products manually from your own country, which is going to lead to some long delivery times, or you can use a Europe-based inventory storage and fulfilment center, which is likely to be costly – it also has the downside of meaning you won’t be able to offer Prime delivery.

Fulfilling orders yourself can be a good way to test the market and dip your toes, but once you decide to go all in and store large quantities of stock, FBA is frankly the only real option here:

Fulfilled by Amazon, or Amazon FBA

Using Amazon FBA in Europe isn’t quite as simple as just sending your products to Amazon. There are 3 main FBA options, and which one is best for you will depend heavily on your own budget and requirements.

Let’s take a look at the options:

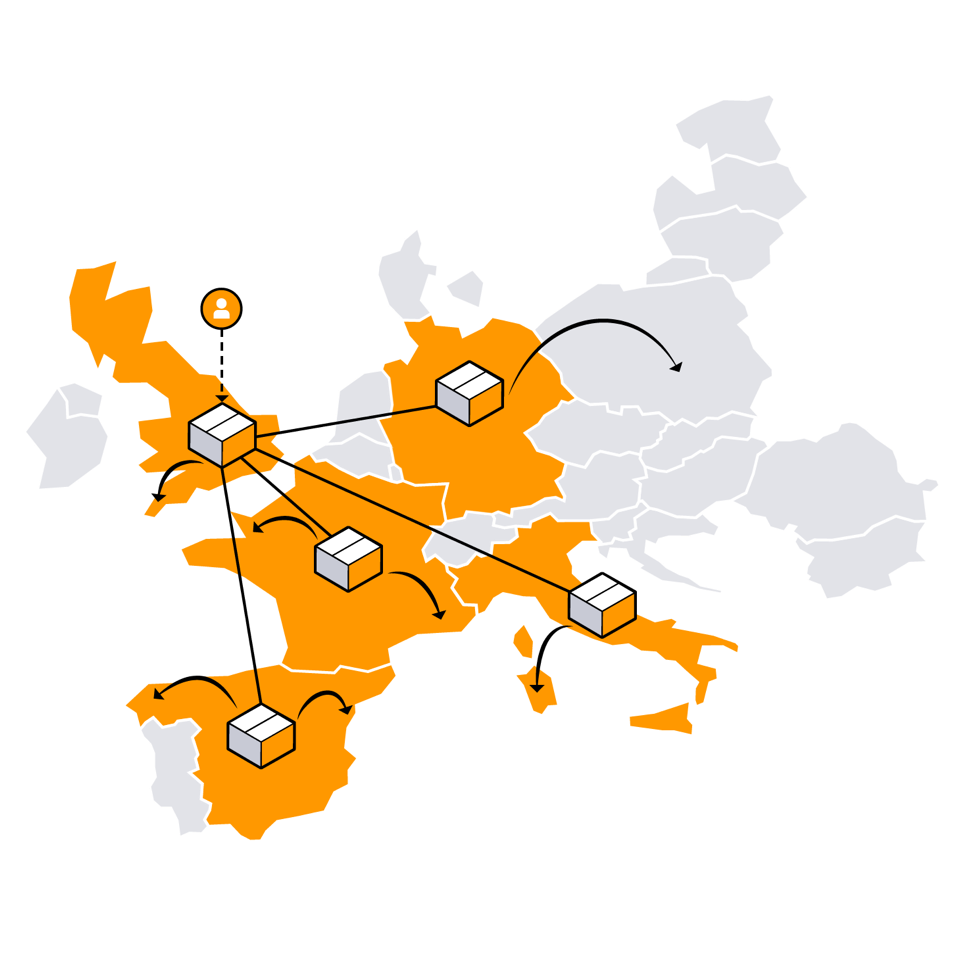

Pan-European FBA

By far the simplest option, this is the route to go if you want Amazon to handle as much as possible for you. This involves you sending your products to a single European fulfilment centre, after which Amazon will spread them amount among others based on their own expectations for sales in different locations.

This also allows you to save a fair bit of money as you can send all of your stock as one shipment instead of sending several smaller ones to different European countries.

This is the best option if you’re already selling in one European marketplace and don’t want to ship products to all of them. For example, if you have inventory at Amazon UK, setting up your listing on Pan European FBA will allow Amazon to move some of your inventory to the other countries and begin to fulfil orders there from your existing stock.

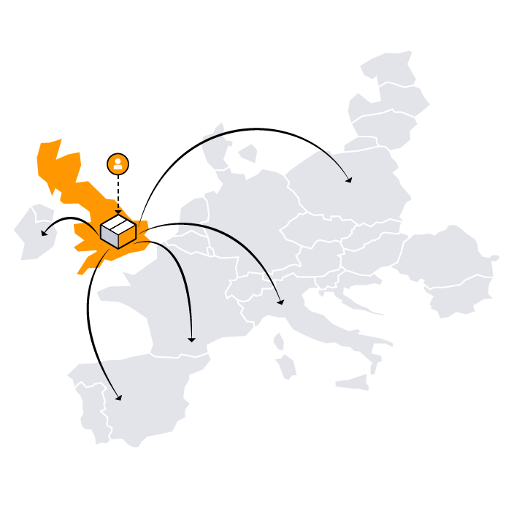

European Fulfilment Network or EFN

This option involves you shipping all of your European inventory to a single fulfilment center in Europe, but instead of Amazon forwarding it on to centers around the continent like with Pan European FBA, it will remain there and orders to the whole of Europe will be fulfilled from this one location.

This is just as easy as Pan-European FBA at first, but does involve longer shipping times and more cross-border deliveries, which can get a little more complicated and reduce conversions.

It may be the best option if you only expect your product to do well in one European country though – for example, if you’re selling an English copy of a book – you can just stock it in the UK. This means people in the other countries can still buy it if they wish, but you aren’t sending stock to those places where it’s less likely.

Multi-Country Inventory or MCI

This option allows you to manually decide where your products are stored, sending individual stock shipments to distribution centers in different countries.

If you know your products have higher demand in some European countries than others, this may be the best route as you have full control of which products are sent where, making it easy to avoid overstocking in places with less demand.

It also means you can put your stock closer to your customers, meaning lower shipping costs and times, and less cross-border deliveries.

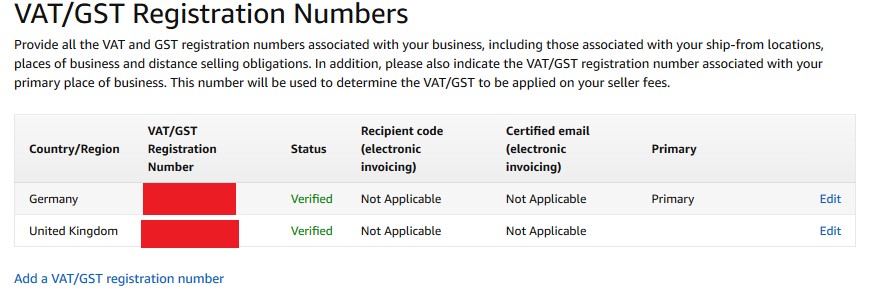

Registering for a VAT and EORI numbers

Now that you’ve selected your home marketplace, it’s time to prioritise that country and learn everything you need to know to sell there in terms of legalities and logistics.

There are two main things you need to sign up for once you’ve gotten to this stage:

- An EORI or Economic Operator Registration and Identification number is necessary for FBM sellers in order to import products into Europe.

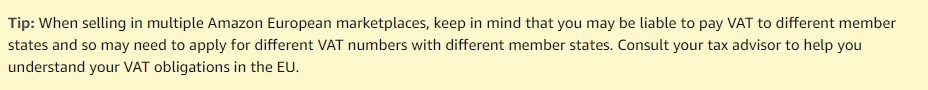

- VAT or Value Added Tax numbers are not only required for both FBA and FBM sellers, but for each individual country you sell in too.

At first, it’s fine to have just a VAT number for your home marketplace and an EORI for Europe as a whole, but as you expand in Europe you will need a VAT number for each individual country you sell in (at least if you are selling above each countries individual tax thresholds).

This is where it begins to get very complicated as if you plan on selling across the entirety of Europe, you will need 28 separate VAT numbers, and each country will have its own percentages, thresholds, and exemption rules.

Getting a European accountant with experience in the different legal requirements in EU countries is a good idea if you’re selling enough to justify it, and can make everything run much more smoothly.

Consider Universal Payment Options to Make Things Easier

When selling in multiple countries, Amazon pays you via your existing bank account in your home country. You may prefer the convenience this provides, which is fine, but you will often be losing out due to fluctuating currency exchange prices.

There are ways around this by using services like Payoneer.

They essentially set up several bank accounts for you in each country and give you easy access to them all via one dashboard, which means you can get paid directly in the currency of each country you do business in.

Payoneer saves you money on exchange fees and is also super convenient as you can instantly open up a receiving account for any new country you begin selling to, without having to do it manually with a bank located in each individual country.

Amazon also works directly with Payoneer, so you can easily and quickly set this up in Seller Central. The end result is an online banking system that works just as well as your existing one, but that allows you to take payments in any currency without losing out due to the FX rate. This is a must for people doing online business globally!

Setting Price Points for Each Country

Setting product prices for each individual country will take some work, as each will have it’s own VAT requirements, customs charges, shipping costs etc.

Now that you have all of this information (or access to an accountant who does) you may choose to do this manually, but in the long run, this will cause a lot of inconveniences as you may be multiplying the work involved in every price change by 27!

Luckily, there are some powerful Amazon repricing tools out there which make it easy to adjust your prices by country or by channel and to set tax rules etc per country that must be included in each price.

There are several options for this, but our guide to the best Amazon seller tools breaks down our favourites and who they are best for, so check that out to learn more.

Language Considerations and Listing Translation

One thing that takes some work in setting up your Amazon business in Europe is the variety of different languages involves.

For one, you will need to provide customer service options in the language of each country you sell in – not an issue if you’re selling on Amazon FBA as Amazon will take care of this for you, but it’s something that can be quite costly for FBM sellers.

Only you can decide whether you sell enough in each individual country for the cost of hiring customer support teams in each language to be worth it. For many of you, it will be worth going with Amazon FBA just so you don’t need to worry about this.

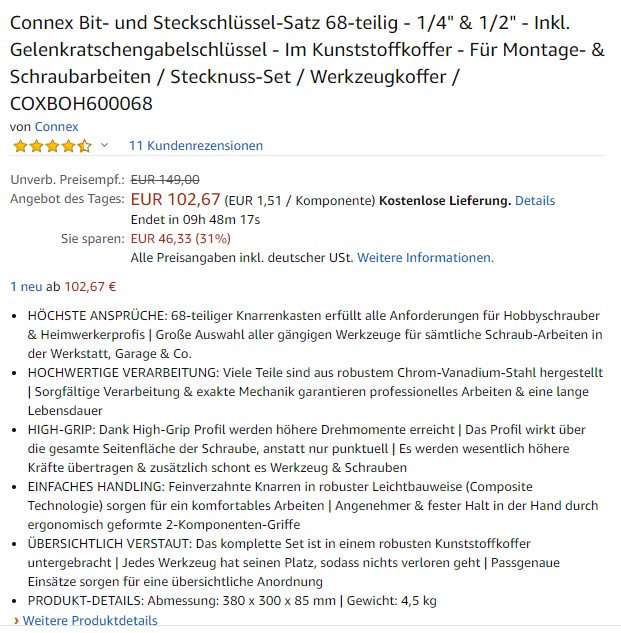

The other side of this is, of course, your product listings, which will need to be rewritten in the language of each country you sell in. Bad translations will hurt your conversions and make you look unprofessional to potential customers from that nation, so high-quality translations are necessary.

Starting in a country with the same language as your home country can start you off easy here, for example in the UK if you’re from the US, or in France if you’re from French-speaking Canada – but even then, different colloquialisms and spellings will need to be taken into account, and it may not be a simple copy and paste job.

There are recommendations for translation options in our list of the best Amazon seller tools.

Your last step is, of course, to list your products and begin making sales!

If you are already successful in the Americas and your research indicates your products have a good demand level in Europe, this can be an incredible way to grow your business.

We have successfully managed international listings for hundreds of clients, not only successfully expanding their business to new countries but achieving high ranking positions in highly competitive niches too.

If you’d rather have our Amazon selling experts handle this for you so you don’t need to worry about it, check out our Case Studies to see what we have already achieved using our unique, self-designed ranking process – or Request a Proposal now to see what results we can achieve for you!