When you first start your online business, you will likely be too focused on things like product research and conversion rate optimisation to even be aware of your average customer lifetime value (CLV).

But once you are set up and are working on scaling your business, you will quickly learn that the average lifetime value of a customer is one of the most important metrics to keep track of!

By comparing it to your average cost of acquisition, you can easily and accurately figure out how long it will take you to get a return on your investment from each customer.

This knowledge will then allow you to use strategies such as loyalty schemes, email marketing, remarketing and gamification to increase your average customer lifetime value and increase your ROI.

In order to find and keep customers with a high value, you need to learn how to calculate customer lifetime value and begin to think about ways to increase it.

What is Customer Lifetime Value?

The simplest way to explain the customer lifetime value definition is that it refers to the average value a business can expect to receive from each customer over the period of their relationship with the company.

So, if your customers spend on average £100 per purchase and make on average 4 purchases from you throughout their lives, your customer lifetime value is £400.

This information allows you to target specific segments of your audience that have a higher lifetime value, stop wasting money targeting ones with a lifetime value that’s too low or come up with strategies to increase the average CLV, making your investment into each acquisition go further.

Building a relationship with your customers via things like loyalty schemes, great customer service, personalisation and regular valuable content will increase your customer lifetime value.

Considering 71% of online shoppers have at some point decided to stop dealing with a company due to a bad customer service experience, it’s perhaps not surprising that the onus on keeping customer relations good and tempting customers to want to keep returning, is entirely on us.

But if calculating CLV is so important, how do you go about working it out?

Not to worry, we’ve got you sorted:

Customer Lifetime Value Formula

The formula for working out your average CLV is:

Average Purchase Value

multiplied by

Average Purchase Frequency Rate

then multiply the answer by

Average Customer Lifespan

If you’re having a little trouble wondering how to figure out those numbers, let’s go a little deeper:

Customer Lifetime Value Calculation

Step 1: Calculate Your Average Purchase/Order Value

This is the easiest part of the CLV calculation – simply divide your total income from the site thus far by the total amount of orders in order to figure out the average purchase value.

Some eCommerce packages will give you this information already, but it’s worth working it out anyway to make sure they haven’t done anything differently.

For the purposes of this example, let’s imagine the average order value is $20.

Step 2: Calculate The Average Frequency Rate of These Purchases

Next, you need to calculate how many times per year the average customer orders from you.

Let’s say in this example that each customer on average, visits our site and makes a purchase 5 times.

Step 3: Calculate the Average Value of Each Customer

Now, we can use the answers to the previous two steps to figure out how much we can expect to earn per customer, per year, on average.

So, based on the example answers we gave previously, the average annual value of each of our customers is $100.

Step 4: Calculate the Average Length of Your Relationship with Each Customer

This one is a little bit more difficult when you’re a newly launched business for obvious reasons, but there are methods to work it out:

- Getting this information from businesses in a similar niche to you that have been around a lot longer, while not 100% accurate to your business, is likely to be pretty close and give you something to work with.

- The more reliable route is to calculate your annual churn rate percentage and divide 1 by it. (Be careful not to get mixed up as the linked page is using months as opposed to years).

For this example, let’s say the average customer deals with us for 10 years.

Step 5: Calculate Your Customer’s Lifetime Value!

Now, it’s fairly easy to use all of the data we calculated above along with the CLV formula listed slightly further up to figure out the customer’s lifetime value.

Based on the examples we used, the average lifetime value of our customers would, of course, be $1000.

We used the simplest numbers we could to make it easy to understand, but chances are your actual numbers will be a little messier than that.

If so, we recommend rounding down instead of up, just to stay on the safe/conservative side of your estimations.

Ok, so now that you know how to work out the lifetime value of a customer, how do you go about improving it?

How to Improve Your Customer Lifetime Value

Loyalty Schemes

Offering your most loyal customers vouchers and discounts, ideally personalised ones based on what they buy most, along with other benefits such as early access to unreleased products or even personal thank you notes all go a long way towards encouraging them to remain customers for the foreseeable future.

Think of things like Tesco Clubcards and the Starbucks cards where you get a stamp for each coffee.

However, there are other ways too, included tier-based loyalty programmes such as Sephora‘s Beauty Insider Loyalty Program and even paid subscriptions such as Amazon Prime.

All of these schemes help to make customers feel special and valued, which has been proven to increase their lifetime spend considerably.

Customer Retention

As I’m sure you’re aware, acquiring a brand new customer can be pretty pricey in terms of PPC ads, Facebook ads, lead generation, or whichever other techniques you use to achieve it.

Improving your customer retention increases the lifetime value of each customer and allows you to enjoy the profits of repeat orders without any new acquisition costs.

It costs at least 5x as much to acquire a new customer as it does to keep an existing one.

Because of this, a 5% increase in customer retention can lead to profit growth of over 25%.

This means you should be pulling out every trick in the book to get your customers to stay happy and stay dealing with you, from great customer service to loyalty schemes, personalised emails, and any other strategies you can come up with.

Customer Satisfaction

Happy customers spend more, it’s that simple.

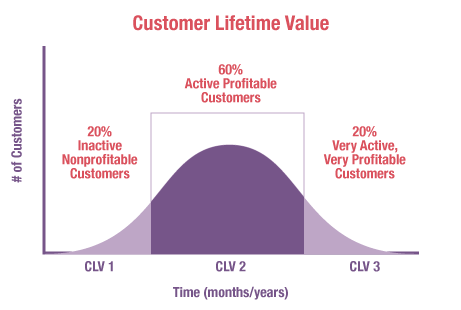

Hopefully, the customer lifetime value graph shown above goes some way to explain that.

Did you know that 70% of customers say they have already made a choice to support a company that delivers great customer service?

Satisfied customers stay customers for longer, so if you want to improve your customer lifetime value, this is a great way to do so.

The amazing thing about customer lifetime value is that it gives you a strong idea of your business’s chances at long term success, whereas most other metrics can only tell you your current or past success, with very little reliable information on what comes next.

Benefits of Increasing Your Customer Lifetime Value

Obviously, more orders, more profits, and a bigger ROI are the main benefit of growing your CLV.

We’ve already explained that, but it’s far from the only benefit.

A better CLV and more lasting business relationships also allow you to:

Target and Segment More Accurately

By grouping your sales data into different segments you can figure out what calls to action, text or triggers helped to push your best customers into buying for the first time.

This allows you to put more effort into these aspects of your marketing and win more high-quality customers with high lifetime values.

In the same way, if a certain trigger or call to action mostly attracts single orders or customers with a low lifetime value, you can stop wasting time and money on it.

Allow Your Customer Service Agents to Organise Time More Efficiently

According to Vilfredo Pareto (yes that one), 80% of your revenue comes from 20% of your customers.

Knowing this information while also knowing your CLV allows your customer service teams to focus more time and effort on high-value customers, making your ROI on customer service higher and improving relationships with your long term customers at the same time.

Bear in mind that while CLV is a predictive formula and is unlikely to be 100% accurate, it is one of the most valuable pieces of data to have on your customers and will allow you to make some incredible refinements and scale your profits extremely quickly.

Customer Lifetime Value Calculator

The below CLV calculator allows you to replace the 3 numbers in the white cells to immediately and accurately work out your average CLV.

That brings us to the end of today’s post.

We hope this guide helps you to understand the power of customer lifetime value and more importantly, how to improve it!

For more in-depth guides to eCommerce and selling via Amazon, keep it locked to the AmazonSEOConsultant blog!

If you’d rather let us manage your eCommerce strategy, consider getting in touch via our proposal form.